Invoice management

What can invoice management of SEAM Tax do?

Many enterprise encountered the problem about invoice of taxation which is very complicated.Traditional mode of single tax management so hard for enterprise financial management system, resulting in information isolations and information barriers.Invoice Management of SEAM Tax(hereinafter referred to SEAM Tax) provides businesses with an efficient and unified invoice management platform, enabling invoice workflow, systematic management, sharing all aspects of invoice information about invoice management to all staff, a variety of internal and external information needs make the efficient maintenance possible,multi-dimensional query function billing information, track the status of invoice and reconciliation to facilitate accurate.

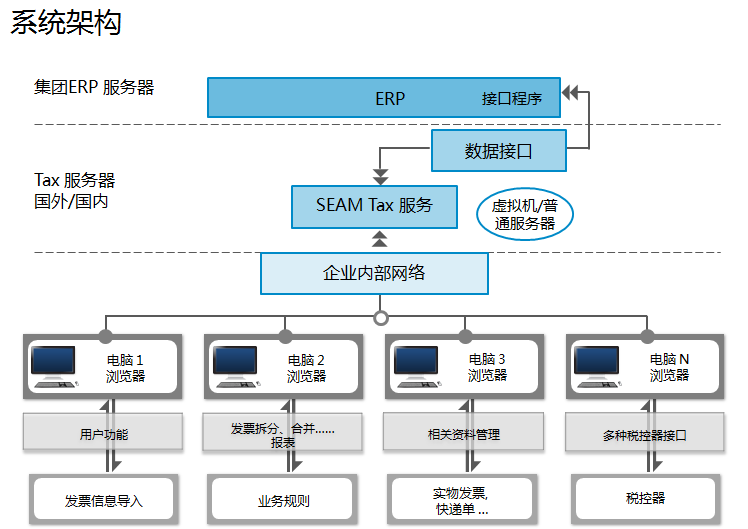

The new 8.0-based B / S architecture make SEAM Tax suitable for complex billing demand enterprises process management and support each subsidiary, multi-sectoral, multi-position work together and multi taxes is also supported.

SEAM Tax aims to corporate tax, all invoices related matters into powerful management system through a combined and innovative model.in the light of coordination working, SEAM Tax establish a real process management system for the real local business activity, and ultimately promote the ability capabilities of information technology of enterprises tax administration and management, establish the information management as an objective for the existence of local tax invoice process to be oriented, and collaborative.

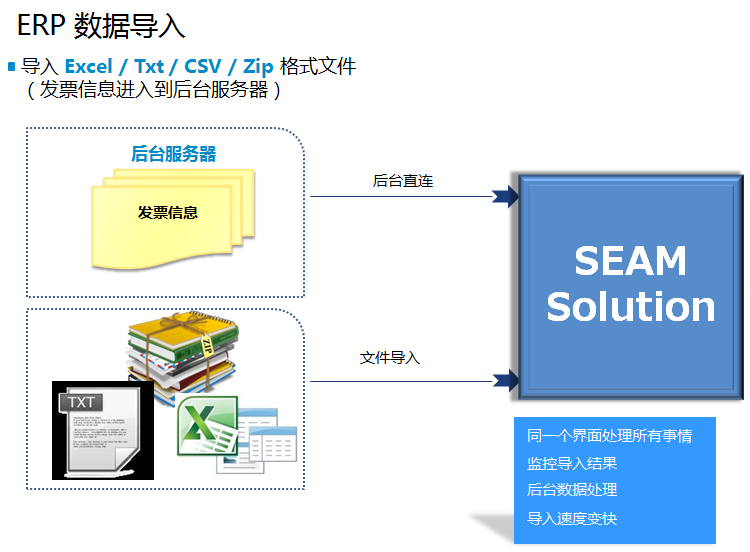

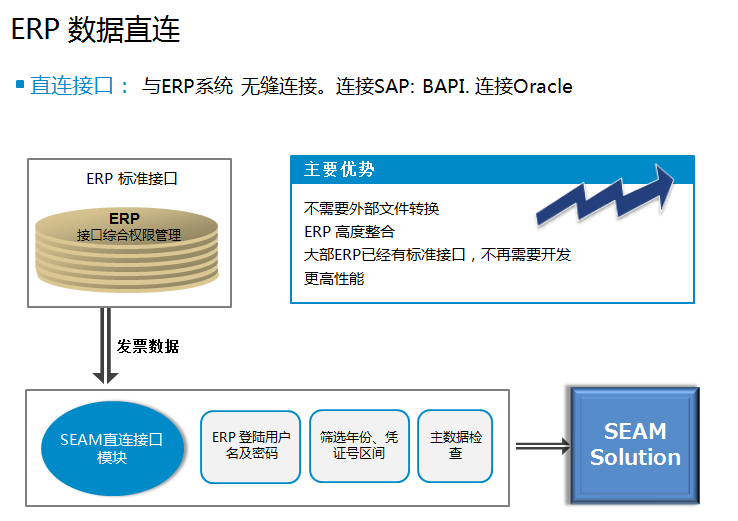

Support for ERP, SAP, Oracle, QAD, Bpcs, Baan, PeopleSoft, JDE, SSA, Sage, Microsoft, Kingdee, UF etc.

Feature of SEAM Tax invoice management

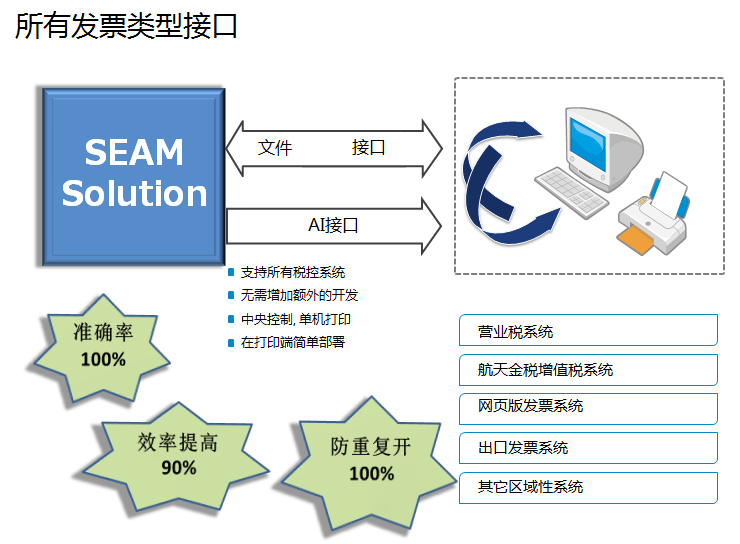

SEAM Tax provides proprietary targeted solutions for different industries in different business characteristics and it’s compatible with various specialized interfaces for different types of tax invoices, so do the same platform.

Adopting B / S architecture,all the various departments involved in the invoice process, and even customers can complete their requirements or responsibilities in the invoice management process by login.

Sharing platform fully guarantee the timeliness and accuracy of the contents of the invoice links, while supporting workflow processes can be strictly controlled from the proposed billing invoice needs(Fiscal machine invoicing) to the final report generation and the whole process can be managed in the invoice platform automatically without external manual work.

Supporting invoice distribution system management , delivery, transfer and other management of back-end processes

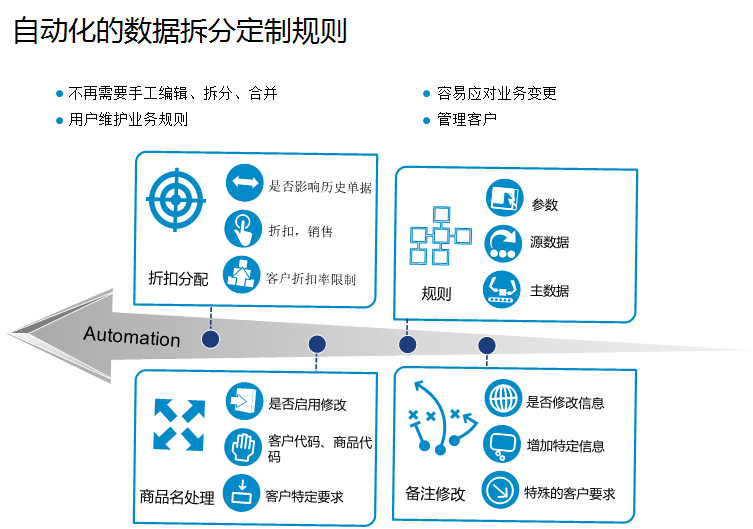

Providing efficient and easy way to use invoice data filtering, modifying, splitting, merging and other restructuring tools

Supporting the collection, automated clearing account, semi-automated work through specially developed tools.

Unified management of VAT and business data, flexible comparison queries,easy identification of accounts data and tax data and provenance differences

More unified management reports can be generated by invoice management platform, objective, true and timely by optimizing the reporting process.

Experiences of client

SEAM Tax process management is for all types of tax, significantly reduce labor costs and time costs in all aspects of enterprises tax invoice management,it can improve management efficiency and help decision-makers to improve the accuracy and scientific basis for making a decision. By Reducing the workload of financial staff, make the original uncontrollable various aspects of invoice management become known, controllable and can be optimized to achieve the invoice process management, systematic management.

.Accuracy on controlling related workflows.

Accelerating the speed of payment by enhancing the efficiency of billing .

Effective control in timeliness, accuracy of tax report.

Reducing communication costs and enhancing the efficiency between subsidiaries and departments .

Ensuring that the financial sector control invoice management in a complex business environment.

Reducing invoice traceability time to achieve precise search.

Invoice management transparent without any information asymmetry.

Avoiding adverse effects due to billing errors and enhancing the company's overall image.

Reducing labor costs and ensure billing accuracy and improving efficiency by volume automatic billing.

(1) Business tax management

SEAM Business Tax

SEAM Tax BT is designed for billing,management and designment of uniform invoice to comprehensively cover the demand from the tax bills interfaces to intelligent management platform, which will transfer tedious and error-prone manual labor into a reliable automatic process.

SEAM Tax BT is completely independent from the enterprise ERP and design satisfactory solution your business without violating your premise enterprise IT management practices.

Background

Shanghai as an example

2007, the Shanghai Internal Revenue Service issued "Shanghai promote the use of automated teller machines opinions" (hereinafter referred to as "Opinion"), "Opinions" requires unity use tax billing machine in commercial retail enterprises in the industry, catering, entertainment, service, culture, sports and other needs .

July 2008, "promote the use of automated teller machines on notice,"indicated that which taxpayers is not in accordance with the installation and use tax means,will be fined.

October 2008, Shanghai IRS and the Inland Revenue Department jointly issued"notification on deepening promoting the popularization and application of automated teller machines " (hereinafter referred to as 'notification'), "notification" requires strengthening on the popularization of tax control machine. It requires “one rate to one machine”and the period for Fiscal cash register sending the copy is adjusted from the 20th of each month to the 10th of each month and other adjustments.

The unified global ERP is generally used in multinational financial management ,but the lack of an effective interface due to the independence between financial systems and tax systems results that the tax process involves a lot of manual work and data between systems artificial multi-pass. Meanwhile, in the ERP of globalization, little service for China invoice management functions, which make invoice and statements process difficult to trace,results in a relatively large impact on the entire financial process.

SEAM SEAM Tax BT launched a business tax invoice management solutions in response to these problems accountants and financial managers in invoice management encountered, .

Solution

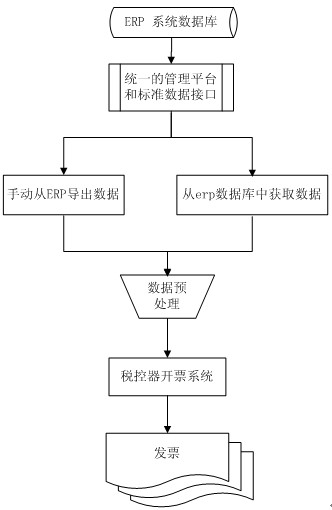

Process as following picture

Features of SEAM Tax BT

Connecting financial systems and tax systems perfectly, preparing billing data for invoicing directly.

Eliminate duplication in invoice processes and ensure data consistency, to maximize the utility of the data.

Suitable for enterprises invoice by using the unified tax control and the plug-in printer.

Help enterprises eliminating manual work in using the plug-tax invoice for better management of invoice information service.

Connecting ERP systems and tax billing system perfectly without additional hardware investment

Provide efficient and useful filtering , modifying, splitting and merging of pending invoices.Optimize the reporting process to easily generate reports about regulation of finance and taxation and other reports.

Uniformly manage the data of invoices and business to achieve a flexible comparison query.

Experiences of client

Completely reduce duplication of data input, BT system will automatically input for easy and convenient printing by entering ERP or POS once.

Integrating the data input and print.

void the possibility of error completely ,improve billing accuracy effectively .

Centralized billing.

Reduce labor costs and improve efficiency.

Reduce invoice traceable time to achieve precise search.

Avoid adverse effects due to billing errors, enhance the company's overall image.

(2)VAT management

SEAM Tax VAT management (hereinafter referred to as: SEAM Tax VAT) is designed specifically for Chinese aerospace Golden Tax Project and for invoice management of the enterprise VAT design.

SEAM Tax VAT is totally independent from the enterprise ERP system,just like SEAM Tax BT, and it’s customized for your business satisfactory solution without violating your premise of enterprise IT management practices, .

Background

In Chinese mainland, the VAT output tax invoice is stipulated to use statutory Golden Tax system, scanning and authentication of input tax deduction associated must be under the provisions of the IRD software and online platforms,and tax returning must be under the unified general tax collection system.

The unified global ERP is generally used in multinational financial management ,but the lack of an effective interface due to the independence between financial systems and tax systems results that the tax process involves a lot of manual work and data between systems artificial multi-pass. Meanwhile, in the ERP of globalization, little service for China invoice management functions, which make invoice and statements process difficult to trace,results in a relatively large impact on the entire financial process.

SEAM SEAM Tax BT launched a business tax invoice management solutions in response to these problems accountants and financial managers in invoice management encountered, .

SEAM Tax VAT Solution

SEAM Tax VAT achieved: automatic billing, automatic data import tax, VAT generated reconciliation , the complete elimination of the invoice process duplication of effort, ensure data consistency, to maximize the utility of the data by the way of the establishment of a unified management platform and data interface and using data from the ERP data and scanning invoices.

SEAM Tax VAT will satisfy the enterprise in the need of upgrading and individual ,regulatory changes and corporate ERP,but it won’t occupy additional time of the finance team and this will extricated the enterprise from conflict with the global ERP implementation plans and restriction of the aerospace Golden interface to help businesses full realization of the effective management in VAT invoice system.

Features

Connecting ERP systems and aerospace Golden Tax system perfectly without additional hardware investment.

Breakthrough the barriers between financial system and VAT system,issue the VAT invoices and read certified VAT data directly.

Unified management of VAT and business data for flexible comparison queries to identify the differences between accounting data and tax dat.

Eliminate duplication in invoice processes and ensure data consistency, to maximize the utility of the data.

Provide efficient and useful filtering , modifying, splitting and merging of pending invoices

Optimize the reporting process to easily generate reports about regulation of finance and taxation and other reports.Uniformly manage the data of invoices and business to achieve a flexible comparison query.

Experiences of client

Completely reduce duplication of data input for more convenient printing Integrating the data input and print to avoid the possibility of error completely ,improve billing accuracy effectively

Centralized billing to reduce labor costs and improve efficiency

Achieve data consistency between the management system and the tax billing system for efficient management of the enterprise.

Reduce invoice traceable time to achieve precise search

Avoid adverse effects due to billing errors, enhance the company's overall image

SEAM Tax VAT standard version (Standard) and Enterprise Edition (Enterprise) versions which Enterprises can select for its own business characteristics

Standard version is designed specifically for the output VAT invoice billing and managing and it’s much more powerful than the aerospace Golden interface.

Enterprise version can fully cover the needs from the interface to the intelligent tax management platform,which will make tedious and error-prone manual work into a reliable automatic process, avoid wrong ticket and make messy data become legible so that you can easily cope with the invoice process while obtaining a strong tax administrative capabilities.